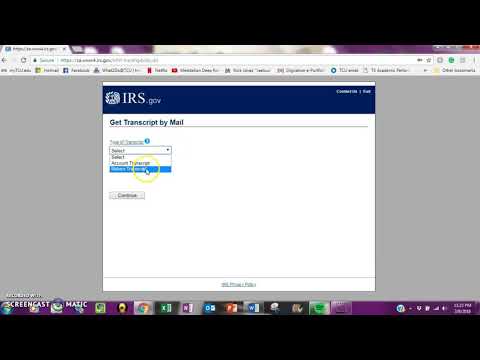

Hey y'all, this video is going to show you how to order a tax return transcript. Normally, I'm getting this done so that I can show you how to do verification for financial aid for college purposes. So, we're gonna go to irs.gov and then in the top right, click on "Talk Part", I'm sorry, type "tax transcript". Then you'll see this link down here that says "Get transcript". You want to do it by mail because the online option requires more information and is more difficult and time-consuming. Just do the by mail option, and it'll come in five to ten days to the address on file. Some reasons to have this information are that you need to input whatever information for the person you're ordering the tax transcript for. If you're ordering for a parent because the college usually asks for parents' tax transcript, then you need to put the parent's social or I-10 if they don't have a social security number, their date of birth, address, and zip code. If the college is asking for a student's tax transcript, the only way you'll have a tax transcript is if you file taxes for the year they're referring to. If you did not file taxes that year, that's okay. You need to do a different form to request a verification of non-filing letter instead of a tax transcript. So, you'll go through the system and put the information, and then I'll show you what's due on the next page. Once you've inputted that information, now you'll be brought to this page. What you want to do is select "return transcript", not "account transcript" because that's the wrong form. Select "return transcript" and then for the year, you need to make sure you're selecting the correct year. The college will...

Award-winning PDF software

Irs 4506 T verification of nonfiling Form: What You Should Know

Fee, which will be sent directly to you when the form is processed. For more information, call) or Option 2. Use Web Request Form for a direct online request. Instructions on how to order forms: This order form asks for the following: (1) Name(s): (2) Address; (3) Fax# (if using electronic filing system): (4) Social Security Number: (5) Mailing Address: NOTE: Mail will be returned for reasons such as incorrect information or not submitted in the proper format or by the mailing deadline. Verification of Non-filing Letter and Certification Form To obtain a verification of non-filing letter you must provide the complete form to the IRS with your tax return. The form must be received no later than 10th day of the month of the tax return. For more information, see IRS Publication 519, Application of Verification of Non-Filing, and IRS Publication 519-A, Verification of Non-Filing. Verification of Non-filing Letter (NFL) In addition to verification of non-filing, the NFL also serves to certify that the return has been submitted. After you receive your verification of non-filing letter, you are required to sign and date a certification form. The certification form must be dated within one year and may only be filed electronically. See Form 4506-T, Verification of Non-Filing, for more information. Instructions on how to order forms: Instructions from IRS Verification of Non-filing Certification To request a copy of your IRS notification letter, complete Form 4506-T, Verification of Non-filing, as described above. Please remember to include your social security number on the signature line of the form. Instructions on how to order forms: Instructions from IRS Tax Tips — How to File for Refund of Refundable Credit and/or Unemployment Insurance There are several tax deadlines that come in a timely manner, and this is no different. It never hurts to be prepared, so make sure you are prepared to file your return (and pay any applicable taxes) quickly. For information on filing deadlines, visit IRS.gov.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-T, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-T online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-T by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-T from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 4506 T verification of nonfiling