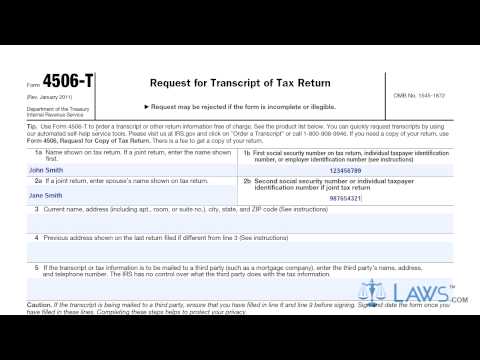

Laws dot-com legal forms guide offers a request form for a transcript of a tax return, known as Form 506-T. - This form is used to request a transcript of any tax return filed with the agency. - It is important to note that the transcript is not an exact copy of the return, and a separate request with Form 506 is required for that. - The Form 506-T can be obtained from the IRS website or at a branch office. - The process for completing the form is as follows: - Step 1: Write your name as it appears on your tax return. If you filed jointly with a spouse, write their name on line 2. - Step 2: Enter the first social security number, tax identification number, or employee identification number listed on your tax return. Include your spouse's number on line 2 if you filed jointly. - Step 3: Write your current address and include your previous address if your last return was filed from a different address. - Step 4: If you want the transcript to be mailed to a different address, provide that address on line 5. - Step 5: List the tax form number for which you want to receive a transcript. - Step 6: Check 6a if you want a return transcript of the form as submitted. These are available for forms 1040, 1065, 1120, and 1120s filed within the last four years. - Step 7: Check 6b if you want an account transcript showing all payments and adjustments made by the IRS. - Step 8: Check 6c if you want a combination of the return and account transcripts. These are available for the previous four years. - Step 9: Check 6d if you want a transcript verifying that you did not submit a tax return in...

Award-winning PDF software

4506-T Form: What You Should Know

Fill in the correct Form 4506‐T using the appropriate instructions for each return. Instructions on how to fill out Form 4506‐T are included on page 1 and 2 and on the back. The following forms are available to use on the back of each form: IRS 2506-EZ Taxpayer Direct Loan Request and Refunds IRS Form 10002-C: Notice of Federal Tax Refund IRS Form 4506‐T: Request for Transcript of Federal Tax Return — IRS To download the downloadable PDF, click on the icon below. Taxpayers using a tax year beginning in one calendar year and ending in the following calendar year will need to use the IRS Form 5508-T and have their tax year-end in either 2017, 2018, 2025 or 2020. See the following page for the correct forms. IRS Form 2501: Application for Federal Unemployment Insurance—IRS You can view an individual's monthly unemployment tax payments online or by calling the Federal Unemployment Tax Center, at. To file electronically, go to and do not use a tax year beginning in 2017. IRS Form 10008-C: Notice of Federal Tax Withholding and Estimated Tax—Internal Revenue Service The form is for a person filing jointly. See the instructions on page 7 to see which forms to use and the required information. Click here for an answer to the most commonly asked questions about the Form 10008. IRS Form 4505–A: Application for Federal Income Tax Return—Internal Revenue Service Taxpayers using a tax year beginning in 2025 or 2025 will need to use the IRS Form 931-ES. IRS 501(c)(3) Taxpayer Identification Number (ITIN, Individual Taxpayer Identification Number) There is no tax liability if Form 4505-A is completed and filed electronically by the IRS. To obtain your ITIN by mail, return it electronically to the following page and send a cover letter. To get your ITIN by mail, return it electronically to the following page and send a cover letter. The IRS will send you a letter describing the new ITIN rules for filing taxes electronically. You can check tax forms at any IRS office or via online tax filing tools such as TurboT ax Online, Inc. You can read more about online returns on our Tax Filing Resources page.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506-T, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506-T online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506-T by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506-T from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4506-T